快速等离子沉积(RPD)3D打印开发人员的股票Norsk Titanium(NOK)尽管公司揭开了新的扩张计划,但仍下降了30.6%。

As revealed in its recent financials, Norsk Titanium generated $1 million in revenue during H2 2021, 233.3% more than the $300,000 it brought in over H1 2021, but still $250,000 to $500,000 less than expected, after it was unable to carry out a contract with clientBoeing,由于其787架飞机周围的监管问题造成的延误。

In light of this, the company’s CEO Michael Canario unveiled plans on its earnings call to diversify its addressable markets, moving into the industrial and defense sectors, with the aim of hitting $150 million in revenue by 2026. However, investors haven’t reacted well to the news, with the firm’s shares diving between the run-up to the results’ release on March 1, 2022, and the 24 hours since their publication.

“尽管我们最大的机会继续存在于商业航空航天结构零件,但我们利用了商业航空航天市场的减速,以将我们的影响力扩大到国防部和其他行业,” Norsk Titanium首席执行官Michael Canario解释说。“我很高兴看到,随着我们在商业航空航天的进步,我们的能力扩展到新市场。”

“We’re moving quickly to try and take our technology across adjacencies that fit our profile and we’re quite excited about those opportunities.”

Norsk Titanium的H2 2021结果

鉴于挪威钛的收益来自机器人h manufacturing and commercial R&D projects, with the latter often arriving in the form of grants, it reports them across two separate divisions: Revenue and Other Income. H2 2021 saw a shift in the firm’s reliance on its Revenue income, which brought in $700,000 more than it had done in H1 2021, as its Other Income fell $1.2 million over the period.

在Norsk Titanium的收益电话中,Canario解释了其业务如何受到“影响整个商业航空航天市场”期间波音飞机交付的延误的影响。但是,引用波音的预测和公司的另一个主要客户Airbus卡纳里奥(Canario)说,该航空可能直到2025年才能完全从Covid-19的影响中恢复过来。

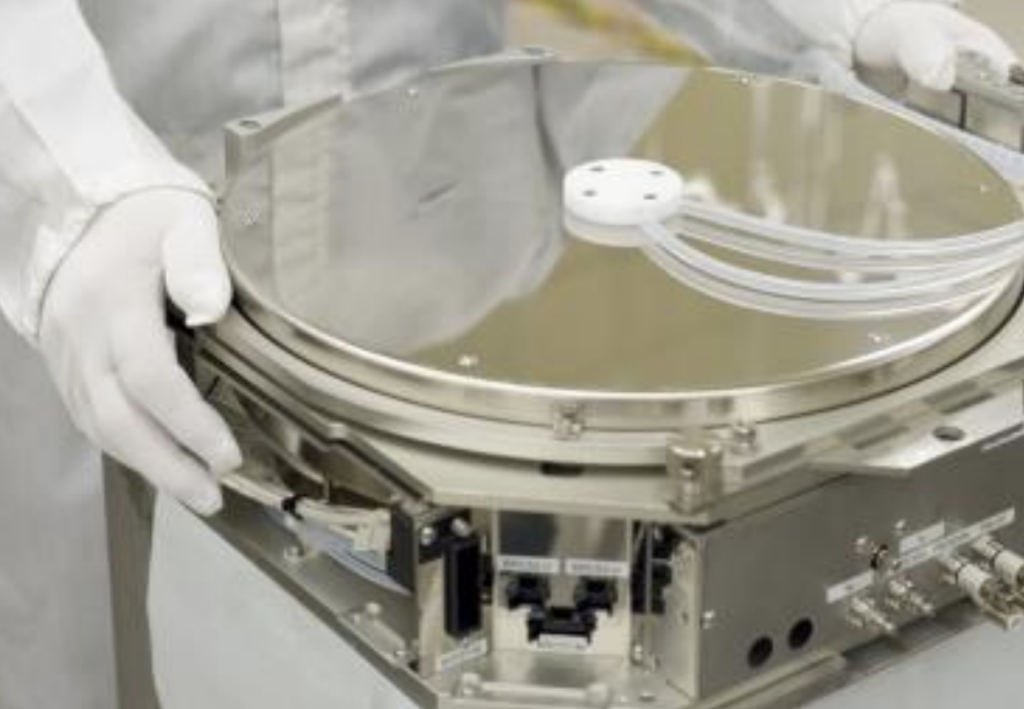

During what turned into a development-focused H2 2021, Norsk Titanium was therefore able to deliver the first part designed using its RPD Builder tool. According to the company, the software is capable of reducing component lead times from weeks to a matter of hours, and it demonstrated this by producing a 120kg demonstrator for semiconductor supplier Hittech, which is now undergoing testing.

Meanwhile, when it comes to the reasons behind Norsk Titanium’s share price decline, it’s likely that investors looked negatively upon its H2 2021 profit/loss results. While the firm managed to raise $33 million over the course of FY 2021, its cash burn rate continues to be around $1.8 million per month, and its EBITDA for H2 2021 came in at -$8.5 million.

Although the business’ VP of Corporate Finance Ashar Ashary clarified on the earnings call that this took its FY 2021 figure to -$16.8 million, a 62.5% rise on the -$27.3 million it reported in FY 2020, and it was committed to becoming “cash-neutral” by 2026, it’s possible that a lack of short-term profitability has affected its investors’ confidence.

| 财务($) | H1 2021 | H2 2021 | 区别 (%) | 2020财年 | 2021财年 | 区别 (%) |

| 收入 | 0.3m | 1m | +233.3 | 0.4m | 1.3m | +225 |

| 其他的收入 | 2.6m | 1.4m | -46.2 | 0.6m | 4m | +566.7 |

| Total | 2.8m | 2.4m | -14.3 | 1m | 5.3m | +430 |

| EBITDA | -8.2m | -8.5m | -3.7 | -27.3m | -16.8m | +62.5 |

| 净利润/损失 | -8.6m | -7.3m | +15.1 | -42.9m | -16m | +168.1 |

A vertical expansion plan

传统上,Norsk Titanium试图通过其DED技术来解决航空航天用例,以前3D打印了结构机身部分为了Spirit Aerosystems,在继续被认可为一部分之前波音的材料允许计划。

但是,在公司的收益电话中,Canario透露,合格此类零件的过程可能需要多年的时间,因此它正在寻求在工业和国防市场中扩展。据说Norsk Titanium正在与两个合作Department of Defense承包商在其Plattsburgh建筑群中获得材料资格,这可能导致其在国防申请中的使用。

“Our first industrial component is now undergoing customer testing and we’re making significant progress on qualifications in the defense industry,” Canario said on the call. “We’re quite happy with the progress that we’ve made in the last 6 months, and we’re very much looking forward to making some significant announcements as we move forward.”

更广泛地说,Canario还强调了采用其技术的成本,交付时间和效率收益如何使其对制造商有吸引力,并且其美国和挪威设施有能力支持高达3亿美元的收入。在接下来的4年中,该公司的首席执行官补充说,它的目标是朝着这一数字迈进,在2023年首先达到1500万美元,然后在2026年到达1.5亿美元。

Plotting a path to profitability

On Russia’s invasion of Ukraine, an issue that has cropped up in numerous earnings calls recently, Canario expressed his wish that fighting would end soon, but said the conflict won’t impact Norsk Titanium short-term, and while he admitted that much of the world’s titanium is Russian, he emphasized the longstanding stability of the alloy’s pricing.

Addressing the firm’s upcoming income and run rate in the call’s Q&A, Ashary added that it’s expecting to gain a Norway Innovation grant worth up to $3 million in FY 2022, and while it finished FY 2021 with $22.9 million in cash, at its current rate of spending, it’ll require $35 million to $40 million more to make it to 2026, capital it’s still looking to raise, and it has left the door open to doing so via equity or debt.

然而,在这次问答结束时,卡纳里奥(Canario)被从这种流动性事项中汲取灵感,回到了诺斯克·钛(Norsk Titanium)垂直扩张的主题。有趣的是,该首席执行官明确表示,尽管他相信RPD在工业和国防环境中的潜力,但他坚持认为其最有利可图的应用仍在航空航天中,因此该公司现在将继续将其研发集中在这一领域。

“We’re pretty confident on the industrial and defense technology adoption and believe that progression into serial production will be faster, but the individual opportunities that we see in those segments, won’t get to double-digit millions quickly,” concluded Canario. “Commercial aerospace has opportunities that are thirty to forty million dollars per application. That’s why we’re on the long path to qualification.”

要了解最新的3D印刷新闻,请不要忘记订阅3D打印行业通讯or follow us on推特or liking our page onFacebook。

为了深入研究添加剂制造,您现在可以订阅我们的雷电竞充值YouTube频道,包括讨论,汇报和3D打印进程的镜头。

您是否正在寻找添加剂制造业的工作?雷电竞充值访问3D打印作业在行业中选择一系列角色。

Featured image shows the production floor at Norsk Titanium’s Plattsburgh facility. Photo via Norsk Titanium.